Public Hearing Notice

Public Hearing Notice: The City of Mount Sterling will hold two public hearings to discuss proposed amendments to City Ordinance 166-90 (AN ORDINANCE RELATING TO THE FINANCE AND COST OF ACQUISITION, CONSTRUCTION, OPERATION AND MAINTENANCE OF FACILITIES USEFUL IN THE ATTRACTION AND PROMOTION OF TOURISTS AND CONVENTION BUSINESS IN THE CITY OF MT. STERLING, KENTUCKY.)  Ordinance 166-90 (Restaurant Tax).pdf

Ordinance 166-90 (Restaurant Tax).pdf

The dates and times of the public hearings as follows: SATURDAY MARCH 14, 2026 from 9:00AM to 10:30AM and TUESDAY MARCH 17, 2026 from 2:30PM to 4:00PM. The location for the public hearings is at City Hall, 33 North Maysville Street, Mt. Sterling, KY 40353. The City of Mount Sterling is aiming to gather community input and feedback. Citizens are encouraged to attend and share their views regarding changes to the current restaurant tax rate, which is currently 2% on the gross retail sales of restaurants doing business within the city limits of Mount Sterling. For individuals who are unable to attend, you may submit comments or questions to the City of Mount Sterling through our website @ mtsterling.ky.gov (Contact Us Tab) or in writing to City Hall, ATTN: 166-90, 33 N Maysville Street, Mt. Sterling KY 40353. You may also submit questions or comments to (859) 498-8725.

When published, you can view the forums HERE

City Business License

Any business or business entity engaged in any occupation, trade, profession, or other business activity conducted for gain or profit in the City, except those activities that qualify as a transient business, shall obtain a business license. The calendar year 2026 fees are $110 for Full Time and $55 for Part Time or Occasional. The cost of a business license for Mobile Vendors (Food Trucks) is $100.

Contact City Hall at (859) 498-8725 if you have any questions.

Ordinance 2023-13 - Business License - City of Mount Sterling.pdf

Ordinance 2023-13 - Business License - City of Mount Sterling.pdf

Business License application -  City of Mount Sterling Business License.pdf

City of Mount Sterling Business License.pdf

Mobile Food Vendor application -  Mobile Food Vendor License Application.pdf

Mobile Food Vendor License Application.pdf

These FOOD TRUCKS are currently licensed to operate in the city limits:  FOOD TRUCKS licensed to operate in the city 2026.pdf

FOOD TRUCKS licensed to operate in the city 2026.pdf

Comprehensive Plan

You can review our Comprehensive Plan HERE .

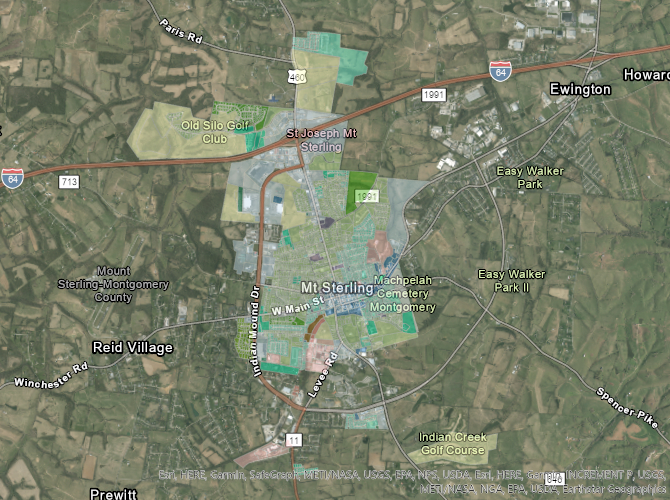

City Map

You can view our City Map here:  Mount Sterling City Map.pdf

Mount Sterling City Map.pdf

Official Zoning Map

You can view the Zoning Map here: ZONING MAP of city